Why Multifamily Apartments Are the Superior Real Estate Investment Product

Multifamily apartment investing involves purchasing properties with multiple rental units that generate income from several tenants simultaneously. Recent market shifts show declining homeownership rates while rental demand continues climbing, creating favorable conditions for apartment investors. This changing landscape makes apartment investing superior to traditional options like stocks, bonds, or single-family rental properties.

Apartment buildings provide stable income through diversified rental streams while reducing risk by spreading it across multiple units. The tax benefits, operational efficiencies, and scalable management structure attract investors who want both security and strong returns. This comprehensive analysis will demonstrate why apartment investing is superior by examining its advantages over other investment types and exploring practical strategies for getting started.

Smart investors recognize that apartments offer more than virtually any other real estate investment when it comes to consistent cash flow, risk mitigation, and long-term wealth building. By the end of this guide, you'll understand how multifamily properties can provide steady income, preserve capital, and create a more secure investment path compared to other alternatives.

- Multifamily properties generate consistent cash flow from diversified rental income, making them more stable than single-income properties

- These investments provide significant tax advantages through depreciation, cost segregation, and other deductions that improve overall financial returns

- The structure preserves capital while reducing risk through multiple income streams from various tenants

- Property values often appreciate based on income generation, allowing investors to "force appreciation" through strategic improvements

- One apartment building can replace multiple single-family rentals, offering superior scalability and management efficiency

- Multifamily investments typically present lower risk profiles than many other asset classes due to diversified income sources

- Passive investment options through syndications allow investors to capture stable returns without hands-on property management responsibilities

Why Apartment Investing Is Superior to Other Options

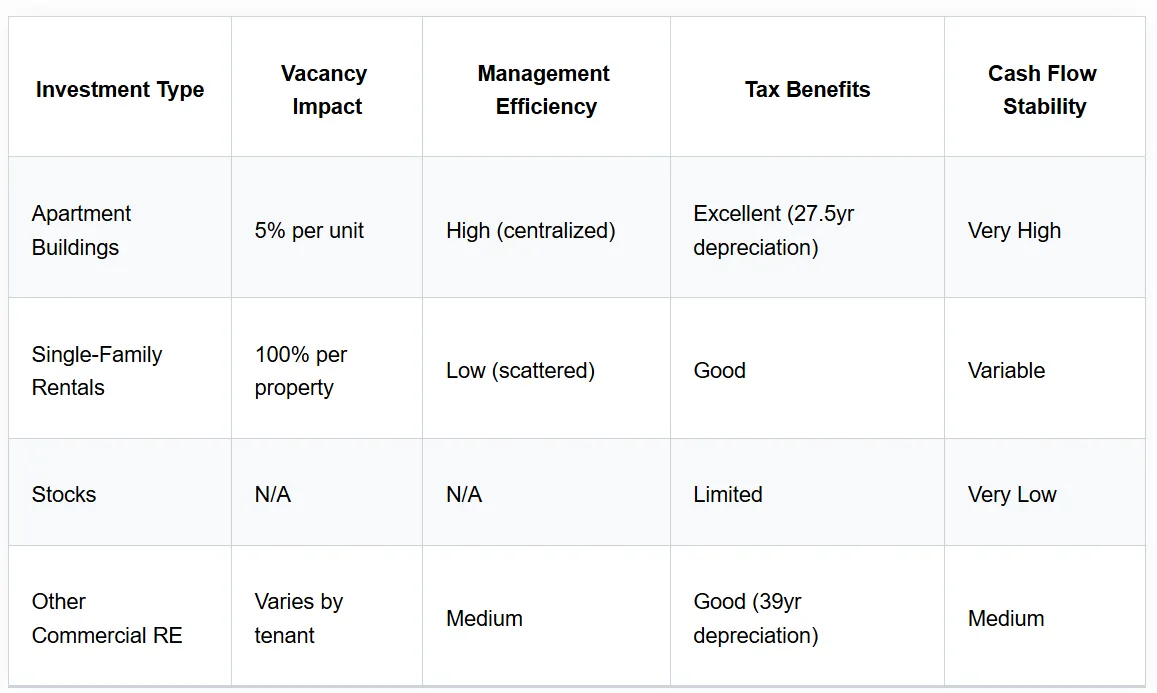

Apartment buildings generate income from multiple sources, creating stability that single-income investments cannot match. When one tenant moves out, the remaining units continue producing cash flow, unlike a single-family rental that loses 100% of its income during vacancy. This diversification makes apartment investing superior for investors who prioritize consistent returns. The economies of scale in apartment buildings reduce per-unit costs for maintenance, management, and improvements compared to scattered single-family properties.

"Multifamily properties have historically provided more stable cash flows and lower volatility than other real estate asset classes. The diversification of income streams from multiple tenants creates a natural hedge against individual tenant risk." - National Association of Real Estate Investment Trusts (NAREIT)

Operational efficiencies contribute significantly to higher returns per dollar invested. Centralized property management allows for streamlined operations, bulk purchasing of supplies, and coordinated maintenance schedules that reduce overall expenses. Professional management becomes cost-effective with larger properties, something that's often prohibitively expensive for individual single-family rentals. Additional revenue streams from laundry facilities, parking fees, storage units, and pet deposits can boost returns by 5-15% annually.

Have you considered how much easier it would be to manage one 20-unit building versus 20 scattered houses?

The risk mitigation benefits extend beyond just vacancy protection. Apartment buildings typically maintain occupancy rates above 90% even during economic downturns because housing remains a basic necessity. Historical data shows multifamily default rates during the 2008 financial crisis were only 0.4% compared to 4.0% for single-family rentals. This resilience makes apartment investing superior for capital preservation during market volatility.

Higher Returns Through Multiple Income Streams

Multifamily properties excel at generating consistent cash flow because they don't rely on a single tenant for all income. Each unit contributes to the overall revenue stream, creating a buffer against individual tenant turnover or payment issues. This stability allows investors to predict cash flow more accurately than with single-family properties or volatile stock dividends. The diversified income streams approach means that even with 10-15% vacancy, the property continues generating substantial returns.

Economies of scale significantly improve profitability in apartment investing. Management companies offer better rates for larger properties, maintenance contracts become more favorable with multiple units, and bulk purchasing reduces supply costs. These efficiencies can improve net operating income by 15-25% compared to managing individual properties separately. Insurance costs per unit decrease substantially when covering multiple units under one policy rather than separate coverage for scattered properties.

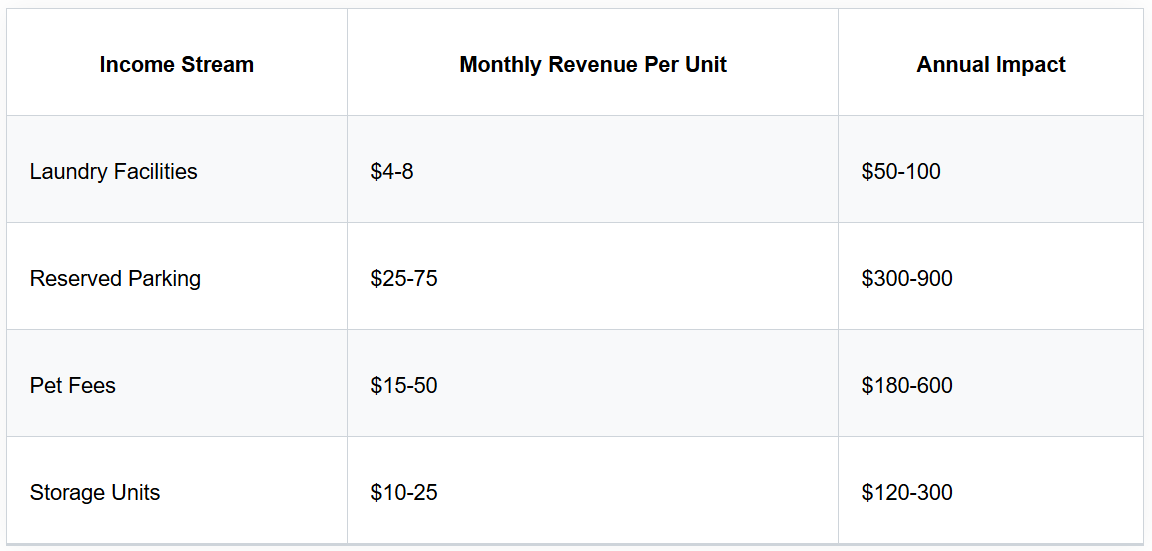

Value-add opportunities in apartment buildings can generate additional income streams beyond basic rent collection. Installing coin-operated laundry facilities can generate $50-100 per unit annually, while reserved parking spaces command $25-75 monthly premiums in many markets. Pet fees, storage rentals, and utility billing services create supplementary income that single-family rentals rarely offer. These ancillary income sources often have minimal additional management requirements while boosting overall returns significantly.

Capital Preservation and Risk Distribution

Risk distribution across multiple units makes apartment investing superior for protecting invested capital. When you own 20 units instead of one house, the impact of any single vacancy drops from 100% income loss to just 5% reduction. This mathematical advantage provides stability that individual properties cannot match, regardless of their quality or location. Default risks spread across multiple tenants create a natural hedge against individual financial difficulties or job losses.

Economic downturns affect apartment buildings differently than other investment types because housing remains essential regardless of market conditions. During recessions, people may delay home purchases but still need places to live, often increasing rental demand. Apartment buildings maintained higher occupancy rates than office or retail properties during recent economic challenges, proving their resilience as an investment class. This stability makes apartment investing superior for investors focused on capital preservation during uncertain times.

The professional management available for larger apartment complexes provides additional risk mitigation through expert oversight. Experienced property managers understand tenant screening, maintenance scheduling, and regulatory compliance better than individual investors managing scattered properties. Their expertise reduces costly mistakes, maintains higher occupancy rates, and ensures proper handling of legal issues that could otherwise create significant financial exposure. This professional oversight adds another layer of protection for invested capital.

Apartment Investing vs. Other Investment Types

Comparing apartment investing to other asset classes reveals why this approach consistently outperforms alternatives. Real estate provides tangible assets that investors can see, touch, and control, unlike paper investments subject to market manipulation or corporate decisions. The combination of cash flow, tax benefits, and appreciation potential creates multiple ways to profit that most other investments cannot match.

Single-Family Rentals: Why Apartments Win

Scaling challenges make single-family rentals inferior to apartment investing for serious investors. Managing 20 individual houses requires dealing with 20 different insurance policies, 20 sets of neighbors, 20 different maintenance schedules, and potentially 20 different markets. One apartment building consolidates all these complexities into a single location with unified management systems. The time savings alone make apartment investing superior for investors who want to scale their portfolios efficiently.

Vacancy impact analysis clearly favors apartment buildings over single-family rentals. When a single-family rental sits empty, you lose 100% of that property's income until finding a new tenant. An apartment building with 5% vacancy still generates 95% of its potential income, maintaining positive cash flow throughout the leasing process. This stability makes apartment investing superior for investors who need consistent monthly income from their real estate portfolios.

Commercial financing for apartment buildings often provides better terms than residential loans for single-family properties. Multifamily loans typically offer longer amortization periods, lower interest rates, and higher loan-to-value ratios than residential investment property loans. These favorable financing terms improve cash-on-cash returns and make apartment investing superior from a leverage perspective. Additionally, commercial loans are based on property income rather than personal income, allowing for easier portfolio expansion.

Professional property management becomes cost-effective at the apartment building level, typically running 4-8% of gross income for larger properties. This same percentage applied to scattered single-family rentals might only cover basic rent collection, not comprehensive management services. Full-service management for apartment buildings includes maintenance coordination, tenant screening, rent collection, financial reporting, and regulatory compliance. This comprehensive service makes apartment investing superior for passive income generation.

Stock Market: Tangible Assets vs. Paper Promises

Stock market investing lacks the tangible asset backing that makes apartment investing superior for wealth preservation. When you own shares of stock, you own a small piece of paper representing fractional company ownership with no direct control over operations or decisions. Apartment buildings provide physical assets that generate income regardless of stock market fluctuations or corporate boardroom decisions. This tangible nature offers psychological comfort and practical security that paper assets cannot provide.

"Real estate has long been considered a hedge against inflation and market volatility. Unlike stocks, real estate provides both income and potential appreciation while giving investors direct control over their investment." - Robert Kiyosaki, Author of "Rich Dad Poor Dad"

Tax advantages heavily favor apartment investing over stock market returns. Real estate depreciation allows investors to deduct a portion of the property's value each year, often creating paper losses that offset rental income for tax purposes. Cost segregation studies can accelerate these deductions, providing immediate tax benefits that stock investments cannot match. Even profitable apartment investments often show tax losses due to depreciation, allowing investors to keep more of their returns compared to taxable stock dividends or capital gains.

During economic downturns, apartment buildings typically maintain their income-producing capacity while stock values can drop 30-50% or more. The 2008 financial crisis saw stock portfolios lose trillions in value while apartment occupancy rates remained relatively stable because people still needed housing. This resilience makes apartment investing superior for investors who cannot afford significant portfolio volatility, especially those nearing or in retirement.

Cash flow predictability gives apartment investing a significant advantage over stock dividend uncertainty. Rental income arrives monthly with high reliability, while stock dividends can be cut, suspended, or eliminated based on corporate performance or board decisions. Even high-dividend stocks rarely provide the 8-12% cash-on-cash returns that well-managed apartment buildings generate consistently. This reliable income stream makes apartment investing superior for investors who need predictable monthly cash flow.

Commercial Real Estate: Why Housing Always Wins

Demand consistency makes apartment investing superior to other commercial real estate sectors like office, retail, or industrial properties. Everyone needs housing regardless of economic conditions, job changes, or lifestyle preferences, creating steady demand for apartment units. Office space needs fluctuate with business cycles and remote work trends, retail faces e-commerce pressure, and industrial demand varies with manufacturing activity. Housing demand remains constant, making apartment investing superior for stable occupancy rates.

Tenant diversification in apartment buildings surpasses other commercial property types significantly. A 50-unit apartment building might house 50 different tenants from various industries, age groups, and income levels, creating natural diversification against economic changes affecting specific sectors. An office building might depend on one major tenant or a few companies from similar industries, creating concentration risk that apartments naturally avoid. This diversification makes apartment investing superior for risk management.

Financing terms for apartment buildings often exceed those available for other commercial property types. Lenders view multifamily properties as lower risk due to diversified income streams and consistent housing demand, resulting in better interest rates and loan terms. Office, retail, and industrial properties may face stricter lending requirements, higher down payment demands, or shorter loan terms that reduce investment returns. These favorable financing conditions make apartment investing superior from a capital efficiency perspective.

Shorter depreciation schedules benefit apartment investors compared to other commercial real estate owners. Residential rental properties depreciate over 27.5 years for tax purposes, while commercial properties use 39-year schedules, significantly reducing annual deduction amounts. This accelerated depreciation timeline provides larger tax benefits sooner, improving after-tax returns and cash flow for apartment investors. The tax advantages alone make apartment investing superior to most other commercial real estate options.

Tax Benefits and Wealth Building Potential

Tax advantages make apartment investing superior to most other investment options available to high-net-worth individuals. The combination of depreciation deductions, cost segregation benefits, and various expense write-offs can significantly reduce taxable income while maintaining positive cash flow. These benefits compound over time, allowing investors to keep more of their returns compared to taxable investments like stocks or bonds.

"The tax advantages of real estate investing, particularly through depreciation deductions, can significantly enhance after-tax returns compared to traditional investments." - Tom Wheelwright, CPA and Author of "Tax-Free Wealth"

Depreciation and Advanced Tax Strategies

Building depreciation over 27.5 years allows apartment investors to deduct approximately 3.6% of the property's value annually, often creating paper losses that offset rental income for tax purposes. This depreciation continues regardless of whether the property actually decreases in value, providing guaranteed tax benefits that make apartment investing superior to investments without similar deductions. Even appreciating properties can show tax losses due to depreciation, allowing investors to keep more of their cash flow.

Cost segregation studies can accelerate depreciation on certain property components, moving some deductions from the 27.5-year schedule to 5, 7, or 15-year schedules. Items like carpeting, appliances, landscaping, and certain building systems can be depreciated much faster, providing immediate tax benefits that improve cash-on-cash returns. Professional cost segregation studies typically cost $5,000-15,000 but can generate first-year tax benefits of $50,000-200,000 or more on larger properties.

K-1 tax forms pass these deductions directly to investors in syndication deals, allowing passive investors to benefit from depreciation without direct property ownership responsibilities. These deductions can offset income from other sources, not just the real estate investment itself, providing broader tax planning benefits. The ability to use real estate losses against other income makes apartment investing superior for high-income professionals seeking tax-efficient investment strategies.

Forced Appreciation Through Income Enhancement

Property values in apartment investing are directly tied to net operating income rather than subjective market comparisons, creating opportunities for "forced appreciation" through strategic improvements. The income-based valuation method means every dollar of additional monthly income can add $120 in property value at a 10% cap rate, providing immediate returns on value-add investments. This direct correlation between income and value makes apartment investing superior to properties valued primarily on comparable sales.

Value-add strategies can include unit renovations, common area improvements, operational efficiency upgrades, or additional income stream development. Upgrading kitchens and bathrooms might allow $100-200 monthly rent increases per unit, immediately adding $12,000-24,000 in property value per unit at typical cap rates. These improvements often cost less than the value they create, generating immediate equity and higher ongoing cash flow simultaneously.

Rent growth potential in apartment buildings often exceeds inflation rates in growing markets, providing natural hedge against rising costs. Annual rent increases of 3-5% compound over time, steadily increasing both cash flow and property values for long-term holders. This organic growth combined with strategic improvements makes apartment investing superior for wealth building compared to fixed-return investments that lose purchasing power to inflation over time.

Passive Investment Opportunities

Passive apartment investing through syndications allows investors to capture the benefits of multifamily ownership without the time commitment and expertise requirements of direct ownership. This approach makes apartment investing superior for busy professionals, retirees, or anyone seeking passive income without property management responsibilities.

Real Estate Syndications and Investment Funds

Real estate syndications pool investor capital to purchase larger apartment buildings that individual investors typically cannot afford alone. CJR Capital Ventures specializes in these syndication opportunities, acting as the general partner who handles all aspects of property acquisition, management, and eventual sale. Passive investors contribute capital as limited partners and receive quarterly distributions based on the property's performance without any management duties.

"Syndications allow individual investors to access institutional-quality real estate investments that would otherwise be out of reach, providing diversification and professional management." - Ken McElroy, Real Estate Investment Expert

This model provides access to institutional-grade properties that often feature professional management, strategic locations, and value-add opportunities that smaller investors cannot access independently. Syndications typically target properties worth $5-50 million or more, offering economies of scale and professional oversight that make apartment investing superior to smaller, individual investments. The sponsor's expertise in underwriting, financing, and managing these properties reduces risk while potentially increasing returns for passive investors.

Diversification benefits allow investors to spread capital across multiple properties, markets, and sponsors rather than concentrating everything in one investment. CJR Capital Ventures offers various opportunities throughout different markets, allowing investors to build diversified real estate portfolios without the complexity of managing multiple direct investments. This diversification makes apartment investing superior to putting all capital into a single property or market.

Minimum investment requirements for syndications typically range from $50,000 to $250,000, making apartment investing accessible to accredited investors who might not have the $2-5 million needed to purchase similar properties directly. These lower minimums allow for better portfolio diversification while still accessing high-quality investment opportunities that make apartment investing superior to other real estate options requiring larger capital commitments.

Understanding Your Role as a Passive Investor

Passive investors in apartment syndications provide capital and receive returns without any operational responsibilities or time commitments. The sponsor handles all aspects of property management, from tenant relations and maintenance to financial reporting and tax preparation. This hands-off approach makes apartment investing superior for investors who want real estate exposure without becoming landlords or property managers themselves.

Active apartment investing requires significant time, expertise, and capital that many investors cannot or prefer not to commit. Direct ownership involves property search and analysis, financing negotiations, management hiring and oversight, maintenance coordination, and eventual sale planning. The learning curve and time investment make active ownership impractical for many investors, making passive apartment investing superior for those seeking real estate returns without operational involvement.

Distribution schedules in passive apartment investments typically provide quarterly cash payments based on the property's performance, offering regular passive income that many investors use to supplement retirement income or reinvest in additional opportunities. These distributions often range from 6-10% annually on invested capital, providing superior returns to many traditional income investments like bonds or dividend stocks while maintaining the tax benefits of real estate ownership through K-1 reporting.

Why settle for volatile stock returns when you can enjoy stable, tax-advantaged income from essential housing assets?

Investment hold periods typically range from 3-7 years, allowing investors to plan for eventual capital returns while enjoying cash flow during the holding period. This timeline provides a balance between short-term liquidity needs and long-term wealth building that makes apartment investing superior to both shorter-term investments that may not allow for significant appreciation and longer-term investments that tie up capital for decades.

Making Apartment Investing Work for Your Portfolio

Apartment investing offers a compelling combination of consistent cash flow, tax advantages, and capital preservation that makes it superior to most other investment options available today. The diversified income streams, professional management opportunities, and scalability benefits create an investment vehicle that can serve both current income needs and long-term wealth building goals effectively.

The stability provided by essential housing demand, combined with the tangible nature of real estate assets, offers security that volatile stock markets and uncertain bond yields cannot match. For investors seeking alternatives to traditional portfolios, apartment investing provides superior risk-adjusted returns with the added benefits of tax advantages and inflation protection that enhance overall portfolio performance.

Working with experienced sponsors like CJR Capital Ventures allows investors to access these superior apartment investing opportunities through professionally managed syndications. This passive approach captures all the benefits of multifamily ownership while eliminating the time commitments and expertise requirements that make direct investment impractical for many. The future strength of apartment investing remains bright as demographic trends, urbanization, and aff