Should You Underwrite Expenses at 50%? A Deep Dive into Multifamily Underwriting

Underwriting multifamily properties requires a sophisticated approach that goes far beyond basic calculations. When evaluating potential properties, investors must thoroughly assess financial viability and associated risks before committing capital. This evaluation process requires careful analysis of historical performance, market trends, and property-specific factors.

Introduction

Multifamily real estate investment offers significant wealth-building potential, but success hinges on one critical skill: accurate underwriting.

When evaluating potential properties, investors must thoroughly assess financial viability and associated risks before committing capital.

This evaluation process goes far beyond simple calculations - it requires careful analysis of historical performance, market trends, and property-specific factors.

Among the most crucial aspects of multifamily underwriting is expense analysis. After all, revenue tells only half the story; understanding and accurately projecting expenses determines your actual profitability.

Many beginning investors encounter the 50% rule - a simple guideline suggesting that operating expenses typically consume half of a property's gross income. While this rule provides a convenient starting point, relying solely on it represents a dangerous one-size-fits-all approach.

Have you ever wondered why some seemingly promising multifamily investments fail to deliver projected returns?

The answer often lies in inadequate expense underwriting.

Sophisticated investors understand that each property has unique expense characteristics influenced by age, location, tenant profile, and management efficiency.

Using a one-size-fits-all approach like the 50% rule can lead to serious miscalculations.

This article explores why proper underwriting of multifamily properties requires moving beyond simplistic expense ratios.

We'll examine detailed, data-driven approaches that successful investors use to create realistic projections and build lasting wealth.

Through conservative assumptions and thorough analysis, investors can identify stable multifamily opportunities that generate reliable cash flow - the exact approach CJR Capital Ventures employs to deliver consistent returns for their investors.

Key Takeaways

Accurate multifamily expense underwriting demands looking beyond the basic 50% rule toward comprehensive financial analysis.

Historical data serves as the foundation - examining T12 statements and multi-year financial trends reveals patterns that simple ratios can't capture. Property-specific factors like age, location, and management quality significantly impact expense ratios, with variations ranging from 35% to over 60% depending on these characteristics.

Conservative underwriting practices protect investors from unforeseen expenses and market fluctuations.

This includes building contingency funds into projections and stress-testing key variables to ensure investments remain viable even under challenging conditions.

Why do experienced real estate syndicators like CJR Capital Ventures prioritize meticulous expense analysis?

Because properly underwriting multifamily properties creates a buffer against unexpected costs, ultimately safeguarding investor capital and delivering more reliable passive income streams.

Leveraging technology and industry expertise further enhances underwriting accuracy, allowing investors to identify hidden opportunities while avoiding potential pitfalls.

Understanding Multifamily Underwriting and Expense Ratios

Multifamily underwriting serves as the analytical backbone of investment decision-making, enabling investors to evaluate both risk and potential returns with clarity.

This process involves examining historical financial performance, current property conditions, and market trends to create forward-looking projections.

Through thorough underwriting, investors can secure appropriate financing terms, determine offering prices, and establish reasonable return expectations.

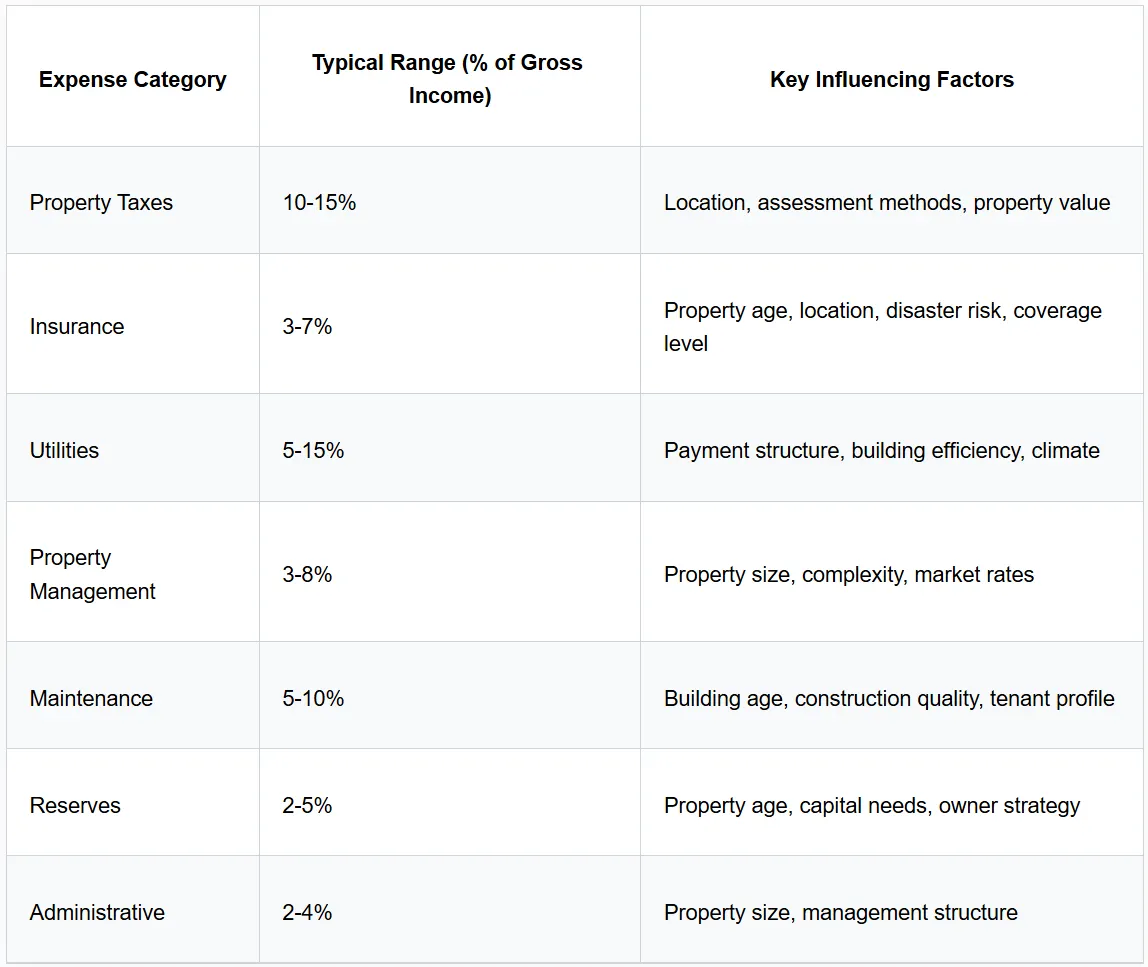

Operating expenses in multifamily properties include a wide range of recurring costs necessary to maintain and operate the asset. These typically encompass:

- Property taxes that vary significantly by location and assessment methods, often representing one of the largest expense categories for multifamily owners. These taxes fund local services but can increase unexpectedly, requiring careful projection in your underwriting models.

- Insurance premiums covering property damage, liability protection, and sometimes flood or other specialized coverage depending on location. These costs have risen substantially in recent years, particularly in areas prone to natural disasters.

- Utilities such as water, sewer, trash collection, and common area electricity. The structure of utility responsibility (owner vs. tenant-paid) dramatically impacts the expense ratio and requires careful consideration during underwriting.

- Property management fees typically ranging from 3-8% of effective gross income depending on property size, complexity, and location. Professional management is essential for most multifamily investments but represents a significant ongoing expense.

- Maintenance costs including routine repairs, landscaping, snow removal, and general upkeep. These expenses fluctuate based on property age, construction quality, and tenant profile.

To quantify these expenses relative to income, investors calculate the expense ratio: operating expenses divided by total operating revenue.

This metric provides a quick snapshot of operational efficiency and allows for benchmarking against industry standards.

Well-managed multifamily properties typically maintain expense ratios between 35% and 50%, though this range varies substantially based on property characteristics.

The "50% rule of thumb" emerged as a simplified starting point for novice investors. While convenient for quick back-of-envelope calculations, it fails to account for the nuanced factors that impact actual expenses.

The rule might work adequately for initial screening, but relying on it for investment decisions represents a risky shortcut that experienced investors avoid.

Why Relying Solely on a 50% Expense Ratio is Insufficient

Applying a standard 50% expense ratio across all multifamily properties ignores the fundamental complexity and variability inherent in real estate operations.

Every property has a unique expense profile shaped by multiple factors that a single percentage simply cannot capture.

This oversimplification often leads to costly miscalculations when underwriting multifamily properties.

Property age and condition significantly impact maintenance requirements and capital expenditures.

A newly constructed apartment building with modern systems might operate efficiently with expenses at 40% of revenue, while a 1970s property with original mechanical systems could easily exceed 55%.

Deferred maintenance compounds these differences, creating expense surprises that devastate projected returns.

Property size introduces another variable through economies of scale.

Consider this: a 100-unit complex typically achieves more efficient operations per unit than a 20-unit building.

Larger properties spread fixed costs (like on-site management) across more units, potentially lowering the overall expense ratio.

Smaller properties often lack this advantage, making the 50% rule particularly problematic for them.

Location and market dynamics cause dramatic variations in expense structures. Properties in high-tax municipalities face fundamentally different cost profiles than those in low-tax areas. Insurance premiums vary by region based on natural disaster risk.

Labor costs for maintenance and repairs fluctuate by market. Even utility rates can differ significantly between neighboring counties.

Have you considered how tenant profiles impact expenses beyond just income generation?

Properties with high turnover experience substantially higher make-ready costs, leasing expenses, and general wear-and-tear.

Student housing typically experiences different usage patterns than senior living communities.

These demographic differences create expense variations that standard ratios fail to capture.

Utility payment structures represent another major variable. A property where tenants pay all utilities directly operates with a fundamentally different expense profile than one where the owner covers water, trash, and common electricity.

The difference can easily shift the expense ratio by 5-10 percentage points.

Management efficiency introduces yet another variable. Professional management companies deliver different cost structures than owner-managed properties.

Fee structures vary, and management quality directly impacts maintenance approaches, vendor relationships, and overall operational efficiency.

Underestimating expenses through reliance on a generic ratio leads to inflated NOI projections and unrealistic cash flow expectations.

This fundamental miscalculation can transform what seemed like a promising investment into a financial drain.

More dangerously, superficial analysis might miss critical red flags like systematic under-maintenance, impending capital needs, or inefficient operations that require immediate attention.

CJR Capital Ventures has observed countless cases where investors relying solely on ratio-based underwriting encountered significant financial surprises after acquisition.

Proper underwriting requires moving beyond simple rules to embrace the complexity of each unique property.

A Detailed Approach to Underwriting Multifamily Expenses

Developing accurate expense projections requires a systematic, evidence-based approach that examines historical performance while accounting for future variables.

This methodology creates a solid foundation for investment decisions and helps identify opportunities for operational improvements.

Begin by gathering and analyzing comprehensive historical financials, including trailing twelve-month (T12) statements and preferably 2-3 years of profit and loss records.

This historical data reveals crucial patterns and anomalies that inform projections. When reviewing these documents, examine each expense line item individually rather than focusing only on category totals.

Look for inconsistencies, unusual spikes, or expenses that appear artificially low compared to market standards.

- Gather comprehensive historical financials including T12 statements and 2-3 years of P&L records

- Examine each expense line item individually rather than just category totals

- Look for inconsistencies or unusual patterns that might indicate problems

- Normalize non-recurring items to establish a realistic baseline

- Cross-reference rent roll with bank deposits to confirm income accuracy

For example, if maintenance expenses suddenly dropped in recent months, investigate whether this represents improved efficiency or deferred maintenance that will create future liabilities.

Similarly, unusually low insurance costs might indicate inadequate coverage rather than operational efficiency.

Normalize any non-recurring items to establish a realistic baseline for projections.

The rent roll deserves equally thorough scrutiny, as it verifies income claims and provides valuable context for expense analysis.

Cross-reference the rent roll with bank deposits to confirm accuracy. Identify any concessions, incentives, or other factors that might distort income projections. Understanding lease expirations helps anticipate turnover-related expenses, while tenant demographics provide insight into likely wear and tear patterns.

Have you compared the subject property's expenses against similar properties in the same market?

Researching local market expense comparables provides essential benchmarking data.

Connect with local property managers, review industry reports, or consult property tax records to establish realistic expense ranges for your specific submarket.

This research helps identify whether the subject property operates efficiently or requires operational improvements to reach market standards.

When forecasting future expenses, incorporate reasonable inflation assumptions that vary by expense category.

Property taxes, insurance, and utilities often increase at different rates than general inflation. Anticipate potential tax reassessments, especially after purchase or significant renovations.

Plan for utility rate increases based on local trends and regulatory environments.

Differentiate clearly between operating expenses and capital expenditures in your underwriting.

While operating expenses recur regularly, capital expenditures represent larger, less frequent investments in the property.

Develop a detailed capital expenditure schedule based on the property's age, condition assessment, and anticipated improvement needs.

This schedule should include both immediate requirements and reserves for future replacements of major systems.

Property-specific factors require particular attention during underwriting.

A thorough physical inspection conducted by qualified professionals helps identify potential maintenance issues before they become expensive emergencies.

Review historical capital improvements to understand the property's maintenance trajectory.

Analyze utility consumption patterns to identify efficiency opportunities.

Throughout this process, maintain conservative assumptions that provide a buffer against unexpected costs.

CJR Capital Ventures consistently applies this meticulous approach to identify multifamily investments with stable, predictable expense profiles that support reliable investor returns.

This methodical analysis forms the foundation for successful multifamily investing beyond simplistic rules of thumb.

The Role of Conservative Underwriting in Mitigating Risk

Conservative underwriting in the multifamily space means deliberately avoiding overly optimistic projections that could mask potential issues.

Rather than assuming best-case scenarios, prudent investors prepare for realistic challenges by building cushions into their financial models.

This approach helps protect capital and ensures sustainable returns even when faced with unexpected circumstances.

In practice, conservative expense underwriting involves several key strategies.

First, experienced investors typically project expenses toward the higher end of reasonable ranges, particularly for variable costs like repairs and maintenance.

They might add 3-5% to historically demonstrated costs to account for potential increases or previously unidentified issues.

This buffer provides crucial protection against budget overruns that could otherwise erode cash flow.

Contingency planning represents another cornerstone of conservative underwriting. Sophisticated investors allocate specific reserves for both anticipated and unexpected capital expenditures.

While a standard capital expenditure reserve might range from $250-350 per unit annually, conservative underwriting might increase this to $400-500 per unit, especially for older properties.

These additional reserves ensure that funds remain available for major systems replacements or emergency repairs without disrupting investor distributions.

Sensitivity analysis allows investors to understand how variations in key expense categories impact overall returns.

By modeling multiple scenarios—such as a 20% increase in property taxes, rising insurance premiums, or higher-than-expected vacancy—investors can identify financial breaking points and develop mitigation strategies.

This stress testing reveals whether an investment remains viable under challenging conditions or depends on perfect execution of optimistic assumptions.

Why does CJR Capital Ventures emphasize conservative underwriting when analyzing potential acquisitions?

Because this approach directly protects investor capital while creating realistic performance expectations.

Conservative underwriting helps avoid investments that appear attractive only under ideal conditions but fail to deliver when facing normal market challenges.

By maintaining strict underwriting standards, investors can build portfolios capable of weathering economic fluctuations while delivering consistent returns.

The relationship between conservative expense underwriting and investment stability cannot be overstated.

Properties underwritten with realistic or slightly conservative assumptions typically perform at or above projections, building investor confidence and supporting long-term wealth creation.

Conversely, properties underwritten with aggressive assumptions often disappoint, creating cash flow challenges that can spiral into serious financial problems.

This conservative methodology aligns perfectly with CJR Capital Ventures' focus on stable, predictable returns.

Their approach prioritizes thorough risk assessment and contingency planning over aggressive yield projections, resulting in investments that deliver reliable passive income even during challenging economic periods.

This stability forms the foundation for building generational wealth through methodical, disciplined multifamily investing.

Leveraging Expertise and Technology in Expense Underwriting

The complexity of modern multifamily expense underwriting demands both specialized knowledge and advanced technological tools.

Partnering with experienced operators provides invaluable insights that spreadsheets alone cannot deliver.

These seasoned professionals understand market-specific nuances, recognize expense patterns, and identify potential efficiencies based on years of hands-on experience managing similar assets.

Experienced operators bring practical knowledge about local vendor relationships, regulatory environments, and tenant expectations that significantly impact expense projections.

They can quickly identify when historical expenses appear unusually high or suspiciously low based on their operational expertise.

This contextual understanding helps investors avoid properties with fundamental expense problems while identifying opportunities where operational improvements could enhance returns.

Technology has revolutionized multifamily underwriting through specialized software solutions that streamline data analysis and improve accuracy.

Modern underwriting platforms automatically extract and categorize financial data from source documents, eliminating manual entry errors while saving countless hours.

These systems can quickly normalize historical data, identify trends, and flag anomalies that might otherwise go unnoticed.

Advanced data analytics tools provide access to comprehensive market benchmarks, allowing investors to compare subject property performance against similar assets.

This comparative analysis helps establish realistic expense projections based on actual market data rather than general assumptions.

Some platforms even incorporate machine learning algorithms that improve projection accuracy by analyzing thousands of comparable properties.

These technological advantages help overcome traditional challenges in expense underwriting. Rather than struggling with inconsistent data formats or manual spreadsheet errors, investors can focus on strategic decision-making based on reliable information.

Automated sensitivity analysis allows for rapid testing of multiple scenarios, providing deeper insights into potential risks and opportunities.

CJR Capital Ventures combines industry expertise with cutting-edge technology to create a robust underwriting process.

Their approach integrates detailed market knowledge with data-driven analysis, resulting in expense projections that consistently align with actual performance. This methodology gives investors confidence that projected returns reflect realistic expectations rather than wishful thinking.

The synergy between experienced operators and advanced technology creates a powerful advantage in identifying promising investment opportunities.

By leveraging both human expertise and computational capabilities, investors can develop nuanced underwriting models that capture property-specific factors while maintaining efficiency.

This integrated approach represents the future of multifamily underwriting, moving well beyond simplistic rules toward sophisticated, data-informed decision-making.

Conclusion

The 50% expense ratio rule provides nothing more than a rudimentary starting point that fails to capture the complexity of multifamily properties.

Successful investors recognize that accurate expense underwriting requires a detailed, property-specific approach incorporating historical data, market comparables, and forward-looking projections.

This nuanced methodology reveals the true operating potential of a property beyond what any simplified rule can provide.

The importance of conservative assumptions cannot be overstated in multifamily underwriting.

By building reasonable cushions into projections and thoroughly stress-testing financial models, investors protect their capital against unexpected challenges while creating realistic performance expectations.

This conservative approach forms the foundation for stable, predictable returns that support long-term wealth creation.

Data-driven analysis, combined with experienced operational insights, enables investors to identify opportunities where others might see only standard returns. Through meticulous expense underwriting, investors can recognize properties with optimization potential while avoiding those with hidden financial risks.

This detailed approach allows for confident decision-making based on substantiated projections rather than hopeful assumptions.

CJR Capital Ventures exemplifies this methodical underwriting philosophy, prioritizing thorough analysis and conservative projections in their multifamily investments.

Their approach focuses on delivering reliable passive income streams by ensuring expense projections accurately reflect property realities.

This commitment to underwriting excellence provides investors with multifamily opportunities designed for sustainable returns and stable performance across market cycles.

For investors seeking to build generational wealth through multifamily real estate, moving beyond simplified rules toward comprehensive underwriting represents a crucial step.

By embracing this detailed methodology, investors position themselves to identify truly exceptional opportunities while avoiding costly underwriting mistakes.

FAQs

What is a typical range for multifamily expense ratios? Multifamily expense ratios typically range from 35% to 55% of effective gross income, varying significantly based on property age, location, class, and management efficiency. Newer Class A properties in favorable tax environments might operate below 40%, while older Class C properties in high-tax jurisdictions could exceed 55%. Rather than targeting a specific ratio, focus on verifying that each expense category aligns with market standards for comparable properties.

Why is historical financial data important in expense underwriting? Historical financial data provides essential insights into actual property performance beyond theoretical projections. By analyzing 2-3 years of operating history, investors can identify expense trends, seasonal variations, and potential anomalies that inform accurate forecasting. This historical perspective helps distinguish between one-time expenses and recurring costs, creating a reliable baseline for projections while revealing potential operational inefficiencies or deferred maintenance issues.

What are some common red flags in multifamily expense underwriting? Watch for suspiciously low maintenance expenses that might indicate deferred upkeep, unusually high management fees that drain cash flow, inconsistent utility expenses suggesting possible leaks or inefficiencies, and property tax amounts that don't align with local assessment patterns. Also beware of missing expense categories, capital expenditures incorrectly classified as repairs, and historical financials that show perfect alignment with projections, as real-world operations typically show some variation.

How can technology help with expense underwriting? Technology streamlines the underwriting process through automated data extraction, standardized analysis frameworks, and rapid scenario modeling capabilities. Modern underwriting platforms can process historical financial statements in minutes rather than hours, identify expense anomalies through pattern recognition, and compare subject property performance against thousands of comparable assets. These capabilities reduce human error while enhancing projection accuracy through data-driven insights and comprehensive market benchmarking.

Why is conservative underwriting important for investors? Conservative underwriting protects investor capital by creating financial models that remain viable even when facing unexpected challenges or market fluctuations. This approach builds contingency reserves into projections, anticipates realistic expense increases, and avoids overly optimistic assumptions about operational efficiency. The result is an investment that delivers reliable returns aligned with or exceeding projections, rather than disappointing performance that erodes investor confidence and threatens long-term financial stability.